Kicking off with Auto Insurance Quote Comparison: Which Company Is the Best?, this opening paragraph is designed to captivate and engage the readers, setting the tone for what's to come.

Exploring the importance of comparing auto insurance quotes and factors to consider when choosing the best coverage is essential.

Importance of Auto Insurance Quote Comparison

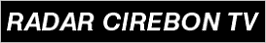

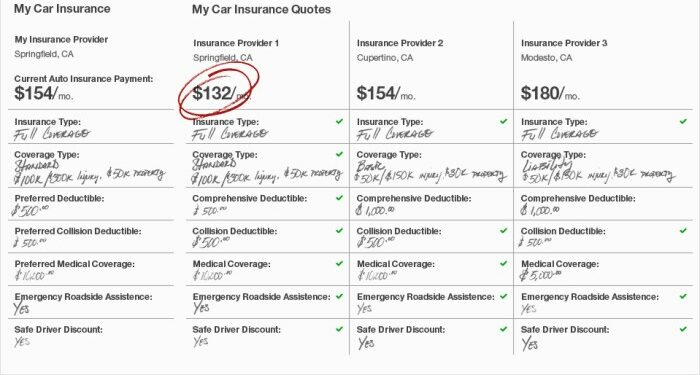

When it comes to getting the best auto insurance coverage, comparing quotes from different companies is essential. This process allows you to make an informed decision based on your specific needs and budget.

Key Factors to Consider

- Coverage Options: Look at the types of coverage offered by each insurance company and determine which one aligns best with your needs.

- Premium Costs: Compare the costs of premiums from various companies to find the most affordable option without compromising on coverage.

- Deductibles: Consider the deductibles that each company offers, as this will impact how much you pay out of pocket in the event of a claim.

- Customer Reviews: Check online reviews and ratings to gauge the customer service and satisfaction levels of each insurance provider.

How It Can Save Money

By comparing auto insurance quotes, you can potentially save a significant amount of money in the long run. Finding a policy that offers the right coverage at a competitive price can help you avoid overpaying for insurance. Additionally, some companies may offer discounts or special deals that you wouldn't be aware of without comparing quotes.

Factors to Consider When Comparing Auto Insurance Quotes

When comparing auto insurance quotes, there are several key factors to take into consideration to ensure you are getting the best coverage at the most competitive rate. These factors include the types of coverage offered, potential discounts available, and the customer service reputation of the insurance providers.

Types of Coverage Offered

Different insurance companies may offer varying types of coverage options, ranging from basic liability coverage to comprehensive coverage that includes protection against theft, vandalism, and natural disasters. It is essential to carefully review and compare the coverage options to ensure you are getting the protection you need at a price that fits your budget.

- Liability Coverage: This covers damages to other vehicles or property in the event of an accident where you are at fault.

- Collision Coverage: This covers damages to your own vehicle in the event of a collision with another vehicle or object.

- Comprehensive Coverage: This covers damages to your vehicle caused by incidents other than collisions, such as theft, vandalism, or natural disasters.

- Personal Injury Protection: This covers medical expenses for you and your passengers in the event of an accident.

Discounts Offered

Insurance companies often provide various discounts that can help you save money on your premiums. These discounts may vary between companies, so it is essential to inquire about them when comparing quotes.

- Multi-Policy Discount: Saving money by bundling your auto insurance with another policy, such as homeowners or renters insurance.

- Good Driver Discount: Rewarding safe driving habits with lower premiums for those without any recent accidents or traffic violations.

- Good Student Discount: Offering discounts for students with good grades, as they are perceived as responsible and less likely to file claims.

- Low Mileage Discount: Providing discounts for drivers who do not drive frequently, as they are considered lower risk.

Customer Service Reputation

The customer service reputation of an insurance provider is crucial, as it can impact your overall experience when filing claims or seeking assistance. Researching customer reviews and ratings can give you valuable insights into how insurance companies treat their policyholders.

Remember to consider not only the price of the policy but also the quality of coverage and customer service offered by the insurance company.

Top Companies for Auto Insurance Quote Comparison

When it comes to comparing auto insurance quotes, it's essential to consider some of the top companies in the industry known for offering competitive rates and excellent coverage options. Let's take a look at some of the best insurance companies for auto insurance comparison and delve into their coverage options, customer reviews, strengths, and weaknesses.

1

. GEICO

- GEICO is well-known for its competitive rates and user-friendly online tools for obtaining quotes.

- They offer a wide range of coverage options, including liability, collision, comprehensive, and more.

- Customers often praise GEICO for their excellent customer service and claims processing efficiency.

- Some customers have reported occasional issues with rate increases after accidents or claims.

2. Progressive

- Progressive is another popular choice for auto insurance comparison, offering competitive rates and a variety of discounts.

- They provide unique coverage options like pet injury protection and gap insurance.

- Customers appreciate Progressive's convenient online tools and mobile app for managing policies.

- Some customers have mentioned occasional communication issues with claims representatives.

3. State Farm

- State Farm is known for its personalized service and extensive network of agents across the country.

- They offer a wide range of coverage options, including rideshare insurance and rental car reimbursement.

- Customers often praise State Farm for their responsive claims handling and reliable customer support.

- Some customers have reported slightly higher premiums compared to other insurance companies.

Tips for Getting the Most Accurate Quotes

When comparing auto insurance quotes, it is crucial to ensure that the information provided is accurate to receive the most precise estimates. Tailoring coverage options to suit your needs can also help you get the best value for your money.

Additionally, reviewing and updating your insurance needs regularly is essential for obtaining accurate quotes.

Ensuring Accuracy of Information Provided

When requesting auto insurance quotes, make sure to provide accurate details about your driving record, vehicle, and coverage requirements. Any inaccuracies in the information provided can result in misleading quotes.

Tailoring Coverage Options for Value

To get the most value for your money, consider customizing your coverage options based on your driving habits, vehicle type, and personal preferences. By tailoring your coverage, you can ensure that you are not overpaying for unnecessary features.

Reviewing and Updating Insurance Needs Regularly

It is important to review and update your insurance needs regularly to reflect any changes in your driving habits, lifestyle, or vehicle. By keeping your information up to date, you can ensure that you are receiving accurate quotes that align with your current situation.

Closure

In conclusion, understanding how different companies stack up in terms of coverage, discounts, and customer service can lead to making an informed decision on which one is the best for your needs.

Key Questions Answered

Why is comparing auto insurance quotes important?

Comparing quotes helps in finding the best coverage at competitive rates, saving money in the long run.

What factors should I consider when comparing quotes?

Key factors include coverage options, discounts, and customer service reputation of insurance companies.

Which companies are known for competitive quotes?

Some of the top companies known for competitive quotes include XYZ Insurance and ABC Insurance.