A Breakdown of Business General Liability Insurance in 2025 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. As we delve into the intricacies of insurance trends and changes, customized policies, risk management strategies, and market conditions, we uncover a roadmap for businesses looking to secure their future in an evolving landscape.

Overview of Business General Liability Insurance

General liability insurance is a crucial coverage that protects businesses from financial losses resulting from third-party claims of bodily injury, property damage, or advertising injury. It provides essential protection against lawsuits and other liabilities that could potentially bankrupt a business.

Purpose of Business General Liability Insurance

Business general liability insurance is designed to cover legal expenses, medical costs, and damages resulting from accidents, injuries, or negligence that occur on business premises or as a result of business operations. This insurance helps businesses mitigate the financial risks associated with lawsuits and liability claims.

Typical Coverage Provided

- Property damage: Coverage for damage to third-party property caused by the business operations.

- Bodily injury: Protection against claims of physical injuries sustained by third parties on business premises.

- Advertising injury: Coverage for claims of slander, libel, copyright infringement, or other advertising-related offenses.

- Legal defense costs: Reimbursement for legal fees and court expenses associated with defending against liability claims.

Importance of Having Business General Liability Insurance

Businesses of all sizes and industries can benefit from having general liability insurance. It provides a safety net against unforeseen accidents, lawsuits, and liabilities that could threaten the financial stability and reputation of a business. From small startups to large corporations, having this insurance is essential for protecting assets and ensuring business continuity.

Trends and Changes in Business General Liability Insurance by 2025

The landscape of business general liability insurance is constantly evolving, and by 2025, we can expect to see several key trends and changes that will shape the industry.Advancements in technology are set to play a significant role in how general liability insurance is offered and priced.

With the rise of Insurtech companies and the use of artificial intelligence and big data analytics, insurance providers will have access to more accurate risk assessment tools. This could result in more tailored policies for businesses, potentially leading to more competitive pricing based on individual risk profiles.One major trend to watch out for is the increasing prevalence of cyber liability insurance as a component of general liability coverage.

As businesses become more reliant on digital technologies and face a growing number of cyber threats, the need for comprehensive protection against data breaches and cyber-attacks has never been more crucial. By 2025, we can expect to see a shift towards bundled policies that include cyber liability coverage alongside traditional general liability insurance.Regulations surrounding business general liability insurance are also expected to undergo changes by 2025.

As the business landscape evolves and new risks emerge, regulators may introduce stricter requirements for coverage or mandate additional protections for certain industries. Keeping abreast of these regulatory changes will be essential for businesses to ensure they are adequately covered and compliant with the law.

Impact of Insurtech on General Liability Insurance

The integration of Insurtech solutions in the insurance industry is revolutionizing the way general liability insurance is underwritten and priced. Insurtech companies leverage technology to streamline processes, enhance risk assessment capabilities, and provide more personalized insurance offerings. This can result in a more efficient and cost-effective insurance experience for businesses, with policies tailored to their specific needs and risk profiles.

Rise of Cyber Liability Insurance

Cyber liability insurance is poised to become an integral part of general liability coverage by 2025. With the increasing frequency and sophistication of cyber-attacks, businesses face growing exposure to data breaches and other cyber risks. Including cyber liability insurance in general liability policies can help businesses mitigate the financial fallout from cyber incidents and protect their sensitive data.

Customized Policies and Options

In the realm of business general liability insurance, customization is key to ensuring that businesses have the right coverage for their specific needs. By tailoring policies to fit their unique circumstances, companies can protect themselves more effectively against potential risks and liabilities.

Options for Customizing Policies

- Choosing coverage limits: Businesses can select the appropriate coverage limits based on the size and nature of their operations. This allows them to ensure they are adequately protected without overpaying for unnecessary coverage.

- Adding endorsements: Companies have the option to add endorsements to their policies to cover specific risks that may not be included in a standard policy. For example, a construction company may add an endorsement for pollution liability coverage.

- Adjusting deductibles: Businesses can adjust their deductibles to manage their out-of-pocket expenses in the event of a claim. Higher deductibles typically result in lower premiums, while lower deductibles may lead to higher premium costs.

Benefits of Customized Policies

- Industry-specific coverage: Customized policies allow businesses in different industries to obtain coverage that is tailored to their unique risks and challenges. For instance, a technology company may require coverage for data breaches, while a restaurant may need coverage for slip-and-fall accidents.

- Cost-effective solutions: By customizing their policies, businesses can avoid paying for coverage they don't need and instead focus on protecting themselves against the risks that are most relevant to their operations. This can result in cost savings in the long run.

- Piece of mind: Knowing that their insurance policy has been customized to address their specific needs can give business owners peace of mind, allowing them to focus on running their operations without constantly worrying about potential risks.

Risk Management and Prevention Strategies

Effective risk management is crucial for businesses to reduce the need for liability claims, ultimately helping to maintain affordable general liability insurance premiums

Implementing Comprehensive Safety Protocols

- Establishing clear safety protocols and procedures for employees to follow in all aspects of the business operations.

- Providing regular safety training to employees to ensure they are aware of potential hazards and know how to respond appropriately.

- Conducting routine safety inspections and maintenance checks to identify and address any safety concerns promptly.

Maintaining Accurate Records and Documentation

- Keeping detailed records of all business activities, transactions, and interactions with customers to provide evidence in case of a liability claim.

- Documenting safety measures, employee training, and incident reports to demonstrate compliance with regulations and industry standards.

- Regularly reviewing and updating records to ensure accuracy and relevance in the event of a claim.

Risk Assessment and Mitigation Strategies

- Conducting regular risk assessments to identify potential hazards and vulnerabilities within the business.

- Implementing risk mitigation strategies to address identified risks and reduce the likelihood of incidents occurring.

- Collaborating with insurance providers to tailor risk management strategies to specific business needs and industry requirements.

Impact of Market Conditions on Insurance Cost

Market conditions play a significant role in determining the cost of general liability insurance for businesses. Fluctuations in the market can directly impact insurance premiums, leading to changes in costs for businesses. It is essential for businesses to understand these factors to navigate through the variations in the insurance market effectively.

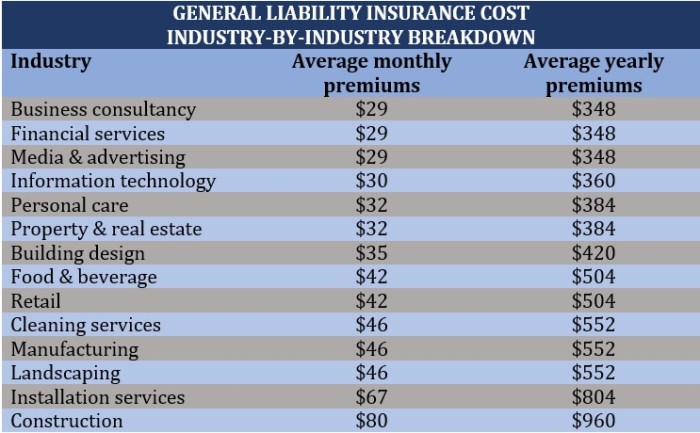

Pricing Factors Influencing Insurance Premiums

- Claims History: A business's past claims history can heavily influence the cost of insurance. Higher numbers of claims or expensive claims can lead to increased premiums.

- Industry Risk: Different industries have varying levels of risk associated with them. Industries with higher risk factors may face higher insurance costs.

- Market Competition: The level of competition among insurance providers can also impact pricing. Increased competition may lead to lower premiums for businesses.

- Economic Conditions: Economic factors such as inflation, interest rates, and overall market stability can affect insurance costs.

Navigating Cost Variations in the Insurance Market

- Review Policies Regularly: Businesses should review their insurance policies regularly to ensure they are getting the best coverage at the most competitive rates.

- Risk Management Practices: Implementing effective risk management strategies can help businesses reduce the likelihood of claims, potentially lowering insurance costs.

- Explore Different Providers: Comparing quotes from multiple insurance providers can help businesses find the most cost-effective coverage options.

- Adjust Coverage Levels: Businesses can adjust their coverage levels based on their needs to optimize insurance costs without compromising on protection.

End of Discussion

In conclusion, A Breakdown of Business General Liability Insurance in 2025 not only sheds light on the current state of insurance but also provides a vision for the future. By understanding the nuances of insurance practices and adapting to emerging trends, businesses can safeguard their interests and thrive in a dynamic marketplace.

Commonly Asked Questions

What factors can influence the cost of general liability insurance?

Factors such as business size, industry risk, claims history, and coverage limits can impact the cost of general liability insurance.

How can businesses customize their general liability insurance policies?

Businesses can customize their policies by adjusting coverage limits, adding endorsements, and tailoring coverage to their specific industry needs.

What role does risk management play in maintaining affordable insurance premiums?

Effective risk management practices can help businesses prevent liabilities, reduce claims, and ultimately lower their insurance premiums.

How do market conditions affect insurance costs?

Market conditions such as supply and demand, economic factors, and industry trends can influence the pricing and availability of insurance.