Starting off with Automotive Insurance Quotes: What’s Included and What’s Not, this introduction aims to grab the readers' attention and provide a brief overview of the topic in a captivating manner.

The following paragraph will delve into the specifics of the topic, offering detailed insights and information.

Overview of Automotive Insurance Quotes

When it comes to getting automotive insurance, quotes play a crucial role in helping individuals find the best coverage at the most competitive rates. These quotes are estimates of the cost of an insurance policy based on various factors such as the driver's age, location, driving record, and the type of vehicle being insured.

Importance of Obtaining Multiple Quotes

Obtaining multiple insurance quotes is essential because it allows individuals to compare prices and coverage options from different providers. By getting quotes from several insurance companies, individuals can make an informed decision about which policy best suits their needs and budget.

This comparison can potentially save them money and ensure they have adequate coverage in case of an accident or other unforeseen events.

- By comparing multiple quotes, individuals can identify any variations in coverage and exclusions that may exist between different insurance providers.

- It helps individuals understand the range of prices available in the market, enabling them to choose a policy that offers the best value for their money.

- Obtaining multiple quotes also gives individuals bargaining power when negotiating with insurance companies, potentially leading to discounts or better offers.

Process of Obtaining Quotes from Different Providers

The process of obtaining quotes from different insurance providers typically involves requesting quotes online or over the phone. Individuals are required to provide information about themselves, their driving history, and the vehicle they want to insure.

It is important to provide accurate information to ensure the quotes received are as close to the final premium as possible.

- After submitting the necessary details, individuals will receive quotes from different insurance companies, usually within a short period.

- Comparing these quotes side by side can help individuals evaluate the coverage options, deductibles, and premiums offered by each provider.

- Once a suitable quote is identified, individuals can proceed to purchase the policy directly from the insurance company or through an agent.

What’s Typically Included in Automotive Insurance Quotes

When obtaining automotive insurance quotes, it is essential to understand what is typically included in the coverage options. This information can help you make informed decisions about the type of insurance that best suits your needs and budget.

Common Coverage Types Included in Quotes

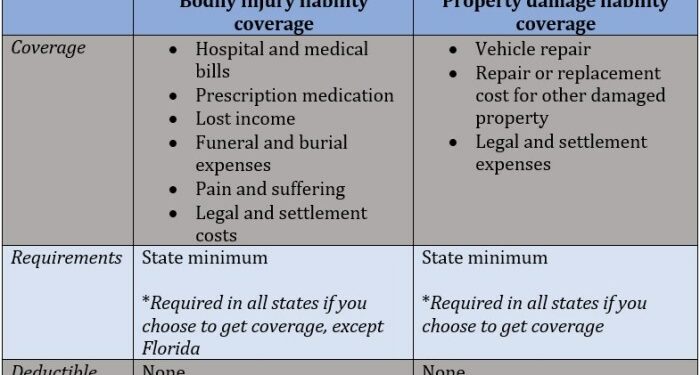

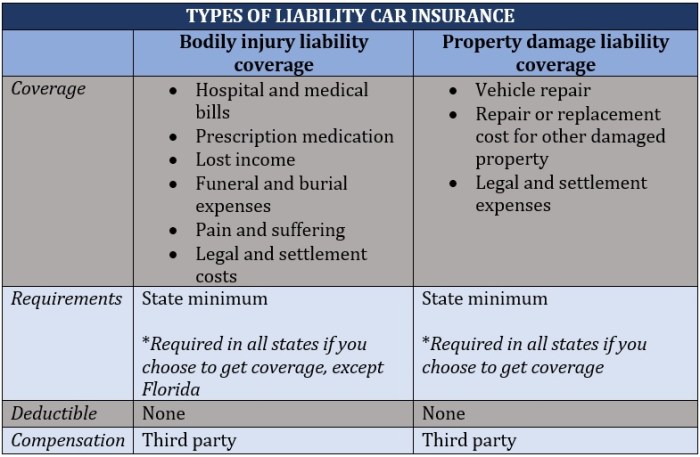

- Liability Coverage: This coverage helps pay for damages or injuries you cause to others in an accident.

- Comprehensive Coverage: This coverage helps pay for damages to your vehicle caused by events other than collisions, such as theft, vandalism, or natural disasters.

- Collision Coverage: This coverage helps pay for damages to your vehicle resulting from a collision with another vehicle or object.

Significance of Liability Coverage

Liability coverage is crucial as it protects you financially in case you are at fault in an accident and need to cover the costs of damages or injuries to others involved. Without liability coverage, you could be personally responsible for paying these expenses out of pocket.

Detail Comprehensive and Collision Coverage

Comprehensive coverage and collision coverage are essential components of automotive insurance quotes as they provide protection for different types of damage to your vehicle. Comprehensive coverage typically covers non-collision incidents, while collision coverage specifically addresses damages from collisions.

Examples of Additional Coverage Options

- Uninsured/Underinsured Motorist Coverage: Protects you if you are in an accident with a driver who has little or no insurance.

- Rental Reimbursement Coverage: Helps cover the cost of a rental car while your vehicle is being repaired after an accident.

- Roadside Assistance: Provides services such as towing, fuel delivery, and tire changes in case of a breakdown.

What’s Not Included in Automotive Insurance Quotes

When obtaining automotive insurance quotes, it is essential to understand what is not included in the coverage to avoid any surprises in the event of a claim. Exclusions and limitations can vary depending on the insurance provider and policy, so it is crucial to carefully review the fine print before making a decision.

Common Exclusions in Automotive Insurance Quotes

- Regular wear and tear: Automotive insurance typically does not cover damage resulting from regular wear and tear of the vehicle.

- Intentional damage: Any damage caused intentionally by the policyholder is usually not covered by insurance.

- Racing or reckless driving: Insurance may not cover accidents that occur while the vehicle is being used for racing or reckless driving.

Limitations of Coverage

- Driving under the influence: Accidents that occur while the driver is under the influence of alcohol or drugs may not be covered by insurance.

- Unapproved drivers: If an unapproved driver is operating the vehicle at the time of an accident, insurance coverage may be limited or denied.

- Commercial use: Personal automotive insurance policies may not cover accidents that occur while the vehicle is being used for commercial purposes.

Importance of Reading the Fine Print

It is crucial to carefully read the fine print of an automotive insurance policy to fully understand what is covered and what is not. By being aware of exclusions and limitations, policyholders can avoid unexpected costs and ensure they have the appropriate coverage for their needs.

Factors Influencing Automotive Insurance Quotes

When it comes to automotive insurance quotes, there are several factors that insurance companies take into consideration before providing a quote. These factors can significantly influence the final cost of your insurance policy.

Driving History

Your driving history plays a crucial role in determining your insurance premium. If you have a clean record with no accidents or traffic violations, you are likely to receive a lower quote. On the other hand, if you have a history of accidents or speeding tickets, your premium may be higher.

Vehicle’s Make and Model

The make and model of your vehicle also impact your insurance quote. High-performance cars or luxury vehicles typically have higher insurance rates due to the cost of repairs and replacement parts. On the other hand, older or less expensive cars may result in lower insurance premiums.

Location and Age

Your location and age are two other factors that can influence your insurance quote. Living in an area with high crime rates or heavy traffic can lead to higher premiums. Additionally, younger drivers tend to pay more for insurance due to their lack of experience behind the wheel.

Other Factors

Aside from driving history, vehicle make and model, location, and age, there are other factors that insurance companies consider. These may include your credit score, annual mileage, and whether you have taken any defensive driving courses. Each of these factors can impact your insurance quote, so it's essential to be aware of how they may affect your premium.

Closing Notes

Concluding the discussion on Automotive Insurance Quotes: What’s Included and What’s Not, this section will provide a concise summary and closing thoughts to wrap up the content.

FAQ Compilation

What are some common coverage types included in automotive insurance quotes?

Common coverage types include liability coverage, comprehensive and collision coverage, and additional coverage options like roadside assistance.

What are some exclusions commonly found in insurance quotes?

Exclusions may involve pre-existing conditions, intentional acts, and certain high-risk activities.

How does driving history impact insurance quotes?

Driving history, including accidents and traffic violations, can significantly influence insurance quotes, with a clean record often resulting in lower premiums.

What factors can affect insurance quotes other than driving history?

Factors like the vehicle's make and model, location, age, credit score, and annual mileage can all play a role in determining insurance quotes.