As Best Low-Cost Insurance Options for Small Businesses Worldwide takes center stage, this opening passage beckons readers with casual formal language style into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

In the realm of insurance for small businesses, finding affordable options is crucial. This guide explores the best low-cost insurance solutions available globally, shedding light on the importance of adequate coverage and cost-effective choices.

Overview of Low-Cost Insurance for Small Businesses

Low-cost insurance for small businesses refers to affordable insurance options that provide necessary coverage to protect businesses from potential risks and liabilities without breaking the bank.

Having insurance coverage is crucial for small businesses as it helps mitigate financial losses in case of unforeseen events such as property damage, lawsuits, or employee injuries. In the absence of insurance, a single incident could lead to significant financial strain or even bankruptcy for a small business.

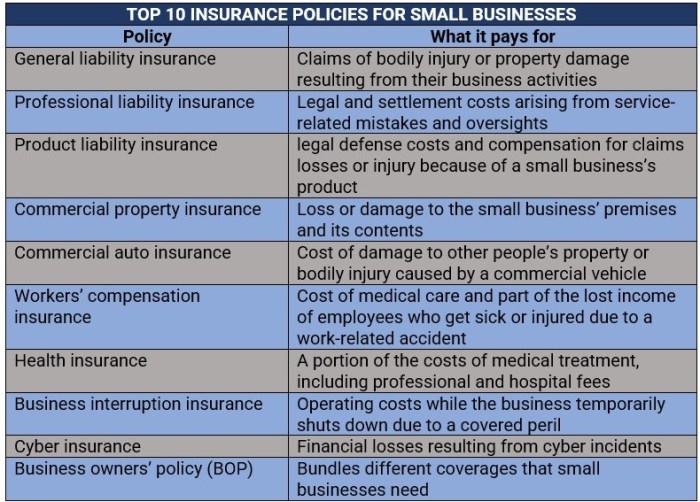

Common Types of Insurance for Small Businesses

- General Liability Insurance: Protects businesses from lawsuits related to bodily injury, property damage, and advertising injury.

- Property Insurance: Covers damage to business property due to fire, theft, or other covered perils.

- Workers' Compensation Insurance: Provides coverage for medical expenses and lost wages for employees injured on the job.

- Professional Liability Insurance: Also known as Errors and Omissions insurance, this coverage protects businesses from claims of negligence or inadequate work.

Benefits of Choosing Low-Cost Insurance Options

- Affordable Protection: Low-cost insurance allows small businesses to access essential coverage at a reasonable price, ensuring financial security without overspending.

- Compliance: Many states and industries require businesses to have certain types of insurance, making it necessary for compliance with legal regulations.

- Peace of Mind: Knowing that your business is protected by insurance can give business owners peace of mind and allow them to focus on running and growing their business without constant worry about potential risks.

Factors to Consider When Choosing Insurance

When selecting insurance for their small businesses, entrepreneurs need to take into account several key factors to ensure they have adequate coverage while keeping costs manageable. Factors such as business size, industry, location, and specific requirements play a crucial role in determining the most suitable insurance options.

Impact of Business Size and Industry on Insurance Needs

Small businesses vary greatly in size and industry, which directly influences their insurance needs. For example, a sole proprietorship may have different risks and coverage requirements compared to a small manufacturing company with multiple employees. Understanding the specific risks associated with the size and industry of the business is essential in choosing the right insurance coverage.

How Location Affects Insurance Options and Costs

The location of a small business can significantly impact insurance options and costs. Businesses operating in regions prone to natural disasters or high crime rates may face higher insurance premiums due to increased risk. On the other hand, businesses located in low-risk areas may have access to more affordable insurance options.

It is crucial for small business owners to consider their location when evaluating insurance choices.

Tips for Assessing Insurance Requirements

1. Conduct a thorough risk assessment

Identify potential risks and liabilities specific to your business operations.

2. Seek professional advice

Consult with insurance agents or brokers who specialize in small business insurance to understand your coverage needs.

3. Compare quotes

Obtain multiple insurance quotes from different providers to ensure you are getting the best coverage at a competitive price.

4. Review policy terms

Carefully read and understand the terms and conditions of insurance policies to ensure they align with your business requirements.

5. Regularly reassess your coverage

As your business grows or changes, review your insurance coverage to make necessary adjustments and ensure you are adequately protected.

Comparison of Low-Cost Insurance Options Worldwide

When it comes to low-cost insurance options for small businesses worldwide, there are various types available that cater to different needs and budgets

Navigating the complexities of choosing insurance across different countries can be challenging, but with the right information, small businesses can make informed choices that protect their interests.

Types of Low-Cost Insurance Available Globally

- General Liability Insurance: Provides coverage for third-party bodily injury, property damage, and advertising injury claims.

- Professional Liability Insurance: Protects against claims of negligence, errors, or omissions in professional services.

- Property Insurance: Covers damages to business property due to fire, theft, vandalism, or other covered perils.

Coverage Limits and Exclusions

- Insurance policies have set coverage limits, which determine the maximum amount the insurer will pay for a claim.

- Exclusions are specific situations or risks that the insurance policy does not cover. It is crucial for small business owners to understand these exclusions to avoid gaps in coverage.

- Reviewing coverage limits and exclusions can help small businesses choose the right insurance that meets their needs.

Reputation and Reliability of Insurance Providers

- Researching the reputation and reliability of insurance providers is essential to ensure that small businesses are dealing with trustworthy companies.

- Reading reviews, checking ratings, and seeking recommendations can help small business owners assess the credibility of insurance providers.

- Choosing a reputable and reliable insurance provider is crucial for small businesses to have peace of mind and adequate protection.

Navigating Insurance Choices Across Different Countries

- Small businesses operating in multiple countries need to understand the regulatory requirements and insurance landscape in each location.

- Working with insurance brokers or agents who have expertise in international insurance can help small businesses navigate the complexities of choosing insurance across different countries.

- Considering the cultural, legal, and economic differences between countries is crucial when selecting insurance options to ensure comprehensive coverage and compliance with local regulations.

Strategies to Save on Insurance Costs

When it comes to managing insurance costs for your small business, there are several strategies you can implement to save money and still ensure adequate coverage.

Bundling Insurance Policies for Cost Savings

One effective way to save on insurance costs is by bundling multiple policies together with the same insurance provider. By consolidating your business's insurance needs, you may be eligible for discounts or lower premiums overall.

Implementing Risk Management Practices

Reducing the risks associated with your business operations can lead to lower insurance costs. By implementing proper risk management practices, such as safety protocols, employee training, and regular maintenance, you can minimize the likelihood of claims and potentially qualify for lower premiums.

Negotiating with Insurance Providers

Don't be afraid to negotiate with your insurance provider for better rates. You can leverage factors like your business's claims history, industry risk factors, and loyalty to the insurance company to potentially secure lower premiums. It's always worth exploring your options and advocating for the best possible rates for your business.

Ending Remarks

In conclusion, navigating the realm of insurance for small businesses can be daunting, but with the right knowledge and understanding of low-cost options, businesses can safeguard their interests without breaking the bank. Explore the world of affordable insurance and secure your business's future today.

FAQ Explained

What does low-cost insurance mean for small businesses?

Low-cost insurance for small businesses typically refers to affordable coverage options that provide necessary protection without imposing a significant financial burden.

How can small businesses lower their insurance premiums?

Small businesses can reduce insurance costs by implementing risk management practices, bundling policies for cost savings, and maintaining a good claims history.

Are there specific insurance types that small businesses commonly need?

Yes, common types of insurance for small businesses include general liability, commercial property, workers' compensation, and business interruption insurance.

How does the location of a small business affect insurance options and costs?

The location of a business can impact insurance costs due to factors like local regulations, crime rates, and environmental risks specific to the area.