How to Find the Cheapest Auto Insurance with Full Coverage sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

Exploring the intricacies of auto insurance coverage, factors affecting rates, tips for affordability, and understanding coverage limits and deductibles, this guide delves deep into the world of insurance to help you navigate the complexities effortlessly.

Understanding Auto Insurance Coverage

Auto insurance coverage is essential for protecting yourself and your vehicle in case of accidents or unforeseen events. Full coverage auto insurance provides a comprehensive level of protection that goes beyond the minimum required by law.

Types of Coverage Included in Full Coverage Auto Insurance

Full coverage auto insurance typically includes the following types of coverage:

- Liability Coverage: This covers damages and injuries you cause to others in an accident.

- Collision Coverage: This pays for repairs to your vehicle in case of a collision, regardless of fault.

- Comprehensive Coverage: This covers damage to your vehicle from non-collision incidents like theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This protects you if you're in an accident with a driver who has insufficient insurance or no insurance at all.

Situations Where Full Coverage Auto Insurance is Beneficial

Full coverage auto insurance is beneficial in various situations, such as:

- Driving a New or Expensive Vehicle: Full coverage ensures your investment is protected in case of damage.

- Living in an Area Prone to Theft or Natural Disasters: Comprehensive coverage can help cover damages from theft, vandalism, or natural disasters.

- Having a Lien on Your Vehicle: Lenders often require full coverage to protect their financial interest in the vehicle.

Factors Affecting Auto Insurance Rates

When it comes to determining auto insurance rates, several factors come into play. Understanding these factors can help you make informed decisions and potentially save money on your premiums.

Age

Age is a significant factor that insurance companies consider when calculating premiums. Younger drivers, especially teenagers, typically face higher insurance rates due to their lack of driving experience and higher risk of accidents. On the other hand, older drivers may also face higher rates as they age, as physical limitations can affect their driving abilities.

Driving Record

Your driving record plays a crucial role in determining your insurance premiums. A clean driving record with no accidents or traffic violations can lead to lower rates, as it indicates responsible driving behavior. On the contrary, a history of accidents, tickets, or DUI convictions can result in higher premiums.

Location

Where you live can also impact your auto insurance rates. Urban areas with higher population densities and increased traffic congestion tend to have higher insurance premiums due to a greater likelihood of accidents and theft. Additionally, areas prone to extreme weather conditions or high crime rates may also lead to higher insurance costs.

Type of Vehicle

The type of vehicle you drive can influence your insurance costs as well. Factors such as the make and model of your car, its age, safety features, and likelihood of theft all play a role in determining premiums. Sports cars and luxury vehicles typically have higher insurance rates compared to more practical and safe vehicles.

Tips for Finding Affordable Full Coverage Auto Insurance

When looking for full coverage auto insurance that fits your budget, it's essential to compare quotes, qualify for discounts, and avoid common mistakes. Follow these tips to find affordable coverage that meets your needs.

Comparing Insurance Quotes

One of the most effective ways to find affordable full coverage auto insurance is by comparing quotes from different providers. Here's a strategy to help you with the process:

- Research multiple insurance companies online or through an agent.

- Provide consistent information when requesting quotes to ensure accuracy.

- Compare coverage limits, deductibles, and additional benefits offered by each provider.

- Consider customer reviews and satisfaction ratings to gauge the quality of service.

Qualifying for Discounts

To lower the cost of your full coverage auto insurance, it's important to take advantage of available discounts. Follow these steps to qualify for discounts:

- Bundle your auto insurance with other policies, such as homeowners or renters insurance.

- Maintain a clean driving record with no accidents or traffic violations.

- Install safety features in your vehicle, such as anti-theft devices or airbags.

- Complete a defensive driving course to demonstrate safe driving habits.

Common Mistakes to Avoid

When searching for affordable full coverage auto insurance, it's crucial to steer clear of common mistakes that could end up costing you more. Here are some pitfalls to avoid:

- Choosing the lowest coverage limits without considering your actual needs.

- Overlooking discounts or failing to ask your insurance provider about available savings.

- Not updating your policy regularly to reflect changes in your driving habits or vehicle.

- Ignoring the importance of comparing quotes from multiple providers before making a decision.

Understanding Coverage Limits and Deductibles

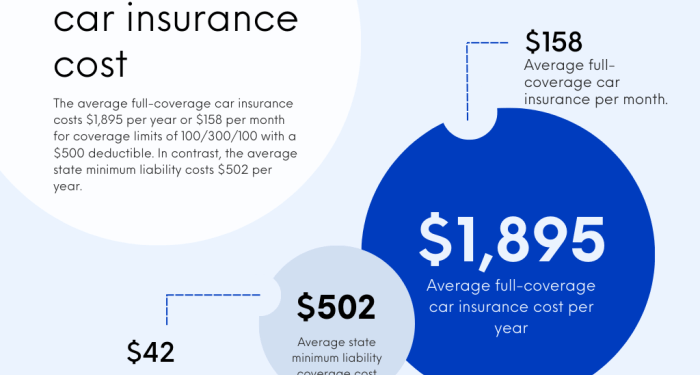

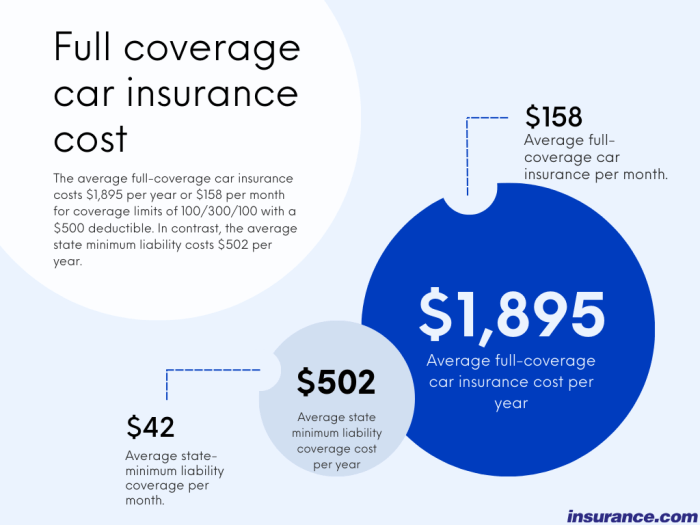

When it comes to auto insurance, understanding coverage limits and deductibles is crucial for making informed decisions about your policy. Coverage limits determine the maximum amount your insurance company will pay for a covered claim, while deductibles represent the amount you must pay out of pocket before your insurance kicks in.

Impact of Coverage Limits on Insurance Premiums

- Higher coverage limits typically result in higher premiums, as you are increasing the amount the insurance company may have to pay out in the event of a claim.

- Lower coverage limits may reduce your premiums, but it also means you may have to pay more out of pocket if the damages exceed your coverage limits.

Effect of Deductibles on Insurance Costs

- Choosing a higher deductible can lower your insurance premiums since you are agreeing to pay more upfront in the event of a claim.

- Conversely, a lower deductible will result in higher premiums, but you will have to pay less out of pocket when filing a claim.

Relationship between Coverage Limits, Deductibles, and Overall Insurance Costs

It's essential to find the right balance between coverage limits and deductibles to ensure you are adequately protected without paying more than necessary for insurance. By adjusting these factors based on your individual needs and financial situation, you can tailor your policy to suit your requirements while keeping costs manageable.

Last Word

In conclusion, the quest for the most affordable full coverage auto insurance is not just a journey of numbers and policies but a strategic approach towards securing comprehensive protection at a reasonable cost. By following the tips and insights shared here, you are better equipped to make informed decisions and find the best insurance coverage for your needs.

General Inquiries

How can I lower my auto insurance premiums?

To lower your auto insurance premiums, you can consider raising your deductible, maintaining a clean driving record, bundling insurance policies, or qualifying for discounts based on your driving habits or affiliations.

What factors can impact my auto insurance rates the most?

The factors that can have a significant impact on your auto insurance rates include your age, driving history, location, type of vehicle you drive, and even your credit score in some cases.

Is it better to go for higher coverage limits or lower deductibles?

It depends on your individual circumstances and risk tolerance. Higher coverage limits provide more protection but come with higher premiums, while lower deductibles mean you pay less out of pocket in case of a claim but can result in higher premiums.